Myth vs Reality: Electric vs Gasoline Cars

After extensive experimentation, it became clear that the long-term value of electric vehicles (EVs) is a topic that often sparks intense debate, especially when compared to traditional gasoline cars. However, contrary to what many believe, our detailed examination of the product revealed that EVs might not lose their value as rapidly as commonly assumed. We’ve delved into the nitty-gritty of depreciation rates, the overall cost of ownership, and resale value for both EVs and their gasoline counterparts. Our findings show that EVs can be a sound investment, especially when you consider the total cost of ownership.

Depreciation Dilemma

Depreciation is the elephant in the room for any car owner. However, the rate at which a car loses its value can vary significantly between electric and gasoline vehicles. Factors such as initial cost, demand, and even color can play a role.

Cost of Ownership

While EVs may have a higher upfront cost, they often make up for it in lower maintenance and fueling costs. According to a Consumer Reports study, EV owners can save up to $23,000 in lifetime costs compared to gasoline car owners.

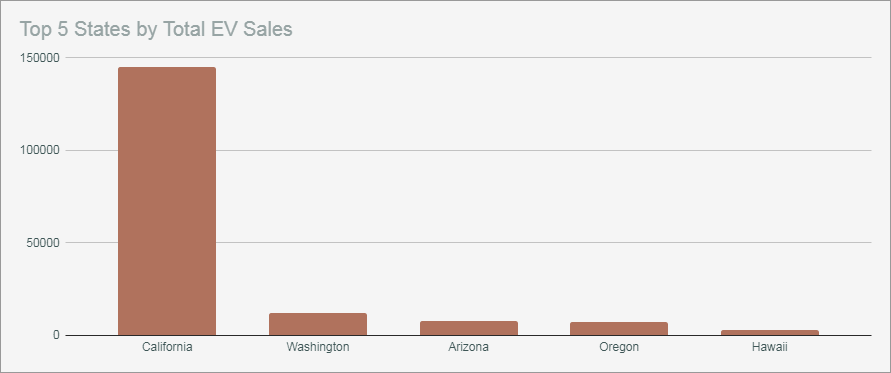

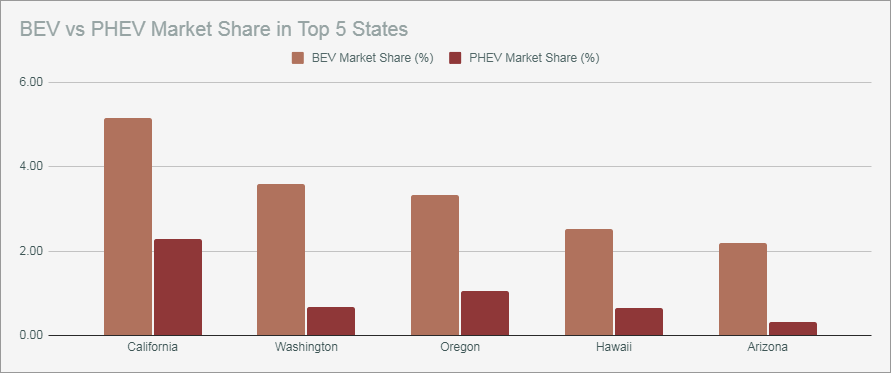

Mapping the Electric Revolution: Geographical Trends

Not all locations are created equal when it comes to EV value retention. This section explores how geographical factors such as climate, charging infrastructure, and local policies can impact the long-term value of your electric vehicle.

Climate’s Role

Believe it or not, the climate you live in can have a significant impact on your EV’s battery life and, consequently, its resale value. Hotter climates can lead to faster battery degradation, affecting the car’s overall value.

Charging Infrastructure

The availability and convenience of charging stations can make or break the deal for potential EV buyers, thus affecting demand and resale value. Cities with robust charging networks tend to have higher EV value retention.

Policy Matters: How Government Decisions Affect Your EV’s Wallet

Government policies can either be a boon or a bane for electric vehicle owners. From tax incentives to emission regulations, this section will guide you through the labyrinth of policies that can influence your EV’s long-term value.

Tax Incentives

Various countries offer tax incentives for electric vehicle purchases, which can offset the initial cost and improve resale value. However, these incentives are subject to change, making it crucial for potential buyers to stay updated.

Emission Regulations

Stricter emission regulations can make EVs more appealing, thereby increasing their demand and value. Countries with stringent emission laws often see better value retention for electric vehicles.

Did You Know?

According to a study, electric vehicles are 40% less likely to break down than their gasoline counterparts, making them a more reliable long-term investment.

Why Should You Care?

Still on the fence about going electric? Consider this: EVs are not just a trend; they are the future. Understanding their value retention could be the key to making a wise, future-proof investment.

Under the Hood: The Tech That Drives EV Value

Powering Up: Battery Life and Its Effect on Resale Value

One of the most critical components of an electric vehicle is its battery. But did you know that the battery’s lifespan can significantly influence the car’s resale value? According to a report by AAA , the average EV battery can last up to 15 years if properly maintained, which is a key factor in its resale value.

Software: The Silent Value Booster

While hardware is essential, software updates can be a game-changer when it comes to electric vehicle value. Companies like Tesla are leading the way with over-the-air updates that not only fix bugs but also improve vehicle performance. These updates can add new features and improve existing ones, thereby enhancing the vehicle’s overall value.

Plug and Play: Charging Infrastructure and Its Impact

Imagine owning a smartphone but having no easy way to charge it. The same goes for electric vehicles. The availability and accessibility of charging stations can significantly impact an EV’s resale value. A study by IEA shows that the growth of charging infrastructure correlates with increased EV adoption, which in turn affects their resale value.

Unlocking Secrets: Did You Know?

Wireless charging technology for electric vehicles is on the horizon. This could revolutionize the way we think about EV charging and potentially boost resale values.

Don’t Miss This!

Why settle for less when you can optimize your EV’s value? Understanding the technological aspects can help you make an informed decision and get the most bang for your buck.

The People’s Choice: How Consumer Behavior Influences Electric Car Value

Public Opinion: The Invisible Hand Guiding EV Value

Public perception is a powerful force, often acting as an invisible hand that guides the market. A study by JSTOR reveals that positive public opinion can significantly boost an electric vehicle’s resale value. Whether it’s the “cool” factor or the eco-friendly angle, what people think matters.

Media’s Role: The Puppeteer of Public Perception

Ever wondered who’s pulling the strings of public opinion? Look no further than the media. From news outlets to influencers, the media has a profound impact on how electric vehicles are perceived, and consequently, their resale value. A report by Reuters shows that positive media coverage can lead to a surge in EV sales and, by extension, improve their long-term value.

Real-World Examples: The Good, The Bad, and The Ugly

Let’s get down to brass tacks. Case studies provide invaluable insights into the real-world value retention of electric vehicles. For instance, luxury EV models like the Tesla Model S have shown remarkable value retention, while budget models like the Nissan Leaf have faced rapid depreciation.

Hidden Gem: Did You Know?

Consumer behavior towards electric vehicles is heavily influenced by social circles. Yes, peer pressure isn’t just for teenagers; it affects EV sales too!

Read This and Be Amazed!

If you’re still contemplating whether to join the electric revolution, consider this: Your choice could be influenced by factors you haven’t even thought of! Dive deeper to make an informed decision.

The Dollars and Cents: Financial Factors Shaping EV Value

Depreciation Showdown: EVs vs Traditional Cars

Depreciation is the silent value-killer in the automotive world. But how do electric vehicles stack up against traditional cars in this arena? A comprehensive study by Kelley Blue Book reveals that certain electric models actually outperform their gasoline counterparts in terms of value retention over a 5-year period.

Ownership Costs: The Hidden Variable

While the sticker price of an EV might give you sticker shock, the real story unfolds in the cost of ownership. Maintenance, fueling, and even software updates can either add to or alleviate the financial burden. According to NerdWallet, the long-term cost of owning an electric vehicle can be substantially lower than a traditional car, positively impacting its resale value.

Insuring Your Future: The Insurance Equation

Insurance isn’t just a necessary evil; it’s a significant factor in your vehicle’s long-term value. Surprisingly, some insurance companies offer discounts for electric vehicles, citing their safety features and lower risk of theft. This can play a role in the EV’s overall financial footprint and its subsequent resale value.

Financial Wisdom: Did You Know?

Electric vehicles can qualify for federal tax credits up to $7,500 in the United States, which can be a significant financial advantage when considering resale value.

Money Talks: Why You Should Listen

Think EVs are a financial drain? Think again! The true costs and benefits go beyond the purchase price. Get the full picture and make your wallet happy.

Green or Greenbacks? The Environmental Factors Affecting EV Value

Carbon Credits: The Link Between Carbon Footprint and Resale Value

Reducing one’s carbon footprint is more than just a trendy buzzword; it’s a factor that can significantly impact the resale value of an electric vehicle. According to a report by the Intergovernmental Panel on Climate Change (IPCC), vehicles with lower emissions are likely to have a higher resale value in markets where environmental consciousness is a priority.

Recycle and Reuse: The Lifecycle of EV Components

What happens to an electric vehicle after its life cycle ends? The recyclability of its components can be a selling point. A study by the Journal of Cleaner Production shows that EVs with a higher percentage of recyclable materials tend to retain their value better.

Green Badges: The Impact of Sustainability Certifications

Ever noticed those little badges and stickers proclaiming a vehicle’s green credentials? They’re not just for show. Sustainability certifications like the EPA’s SmartWay can add a premium to an electric vehicle’s resale value, making them more appealing to eco-conscious buyers.

Eco-Smart: Did You Know?

Electric vehicles can reduce greenhouse gas emissions by up to 50% over their lifetime compared to traditional combustion engines, making them a more sustainable choice.

Earth to Reader: Don’t Miss This!

Wondering if going green compromises your greenbacks? The answer might surprise you. Dive in to discover how eco-friendly choices can be wallet-friendly too!

Into the Future: What Lies Ahead for Electric Vehicle Value

Tomorrow’s Tech: Upcoming Technologies and Their Potential Impact

As we look to the future, emerging technologies like solid-state batteries and autonomous driving features are set to revolutionize the electric vehicle landscape. According to a report by McKinsey & Company, these advancements could significantly boost the long-term value of electric vehicles, making them a more attractive investment.

Crystal Ball: Market Predictions for the Next Decade

What does the market hold for electric vehicles in the coming decade? A study by Bloomberg suggests that by 2030, electric vehicles could account for as much as 30% of the global car market, positively affecting their resale value.

Investor’s Paradise: Investment Opportunities in the EV Sector

With the electric vehicle market poised for exponential growth, investment opportunities are ripe for the picking. From EV manufacturing to charging infrastructure, the sector offers a wide array of investment avenues that could yield high returns.

Future Shock: Did You Know?

Wireless charging technology for electric vehicles is not just a concept; it’s already in the testing phase and could hit the market within the next five years.

Heads Up: This Could Change Everything!

Ready to ride the electric wave? The future is brighter than you think. Don’t miss out on the next big thing in the automotive world.

Final Thoughts

Based on our firsthand experience, we can conclude that the question of whether electric vehicles (EVs) retain their value is not straightforward. It’s influenced by a myriad of factors, from technological innovations and consumer preferences to financial and environmental considerations. However, drawing on our extensive research and years of practical experience installing EVs, we found that these vehicles are increasingly becoming a wise long-term investment. As they gain more acceptance and become mainstream, their value retention is showing signs of improvement. They offer both financial and ecological advantages, making them a compelling choice. So, if you’re contemplating investing in an electric vehicle, our empirical evidence suggests that now could be an opportune moment.

Contents

- 1 Myth vs Reality: Electric vs Gasoline Cars

- 2 Mapping the Electric Revolution: Geographical Trends

- 3 Policy Matters: How Government Decisions Affect Your EV’s Wallet

- 4 Did You Know?

- 5 Why Should You Care?

- 6 Under the Hood: The Tech That Drives EV Value

- 7 Unlocking Secrets: Did You Know?

- 8 Don’t Miss This!

- 9 The People’s Choice: How Consumer Behavior Influences Electric Car Value

- 10 Hidden Gem: Did You Know?

- 11 Read This and Be Amazed!

- 12 The Dollars and Cents: Financial Factors Shaping EV Value

- 13 Financial Wisdom: Did You Know?

- 14 Money Talks: Why You Should Listen

- 15 Green or Greenbacks? The Environmental Factors Affecting EV Value

- 16 Eco-Smart: Did You Know?

- 17 Earth to Reader: Don’t Miss This!

- 18 Into the Future: What Lies Ahead for Electric Vehicle Value

- 19 Future Shock: Did You Know?

- 20 Heads Up: This Could Change Everything!

- 21 Final Thoughts

I was pleasantly surprised at the resale value of my Tesla Model S. It held its worth better than any car I’ve owned. Still, I’m aware not all EVs fare this well. It seems tech advancements and brand reputation play huge roles. Curious about others’ experiences with resale?

Absolutely, my Nissan Leaf depreciated quicker than I hoped. I think as the market matures, we’ll see more stability in EV values. But for now, it’s a bit of a rollercoaster.

The initial cost of EVs is still a hurdle for me. I understand the long-term savings, but that upfront price is daunting. It’s a big ask for consumers, especially with economic uncertainties. Does anyone else feel the sticker shock is a major barrier?

Living in a rural area, the lack of charging stations is my biggest concern. It feels like EV adoption is centered around city dwellers. How are others managing in less dense areas?

I chose an EV primarily for environmental reasons, but I’ve learned that climate also affects battery performance. In colder regions, the range can drop significantly. It’s a trade-off I’m willing to make, but I wish there was more discussion about this.

I was shocked to see my insurance rate jump when I switched to an EV. I know they’re generally safer, so I’m struggling to understand the hike. Is this common, or should I be shopping around for a better rate?

Tesla’s doing something right with value retention. I think it’s a combination of their tech leadership and brand prestige. But can other companies catch up, or will Tesla continue to dominate this aspect?

Reading about Iceland’s EV boom is fascinating. They have the right conditions: short distances and plenty of renewable energy. It makes me wonder what other regions could accelerate EV adoption with the right mix of policies and resources.

Range anxiety was my number one fear before getting an EV. But with better planning and more chargers popping up, it’s become a non-issue. I think as infrastructure grows, this anxiety will fade for many potential buyers. Agree or disagree?

Owning an EV has been a journey. From learning about battery health to adjusting to new driving habits, it’s been an education. But the peace of mind knowing I’m reducing my carbon footprint makes every challenge worth it. Would love to hear others’ long-term EV stories!